Canada’s financial future appeared precarious just months ago, with the nation seemingly hurtling towards a fiscal crisis. The interim parliamentary budget officer, Jason Jacques, publicly warned of a looming “cliff” – a point of no return for the country’s finances.

That stark assessment, delivered in September, painted a picture of unsustainable debt and escalating financial risk. Jacques explained that existing forecasts showed a troubling trend: a steadily increasing debt-to-GDP ratio, a key indicator of economic health.

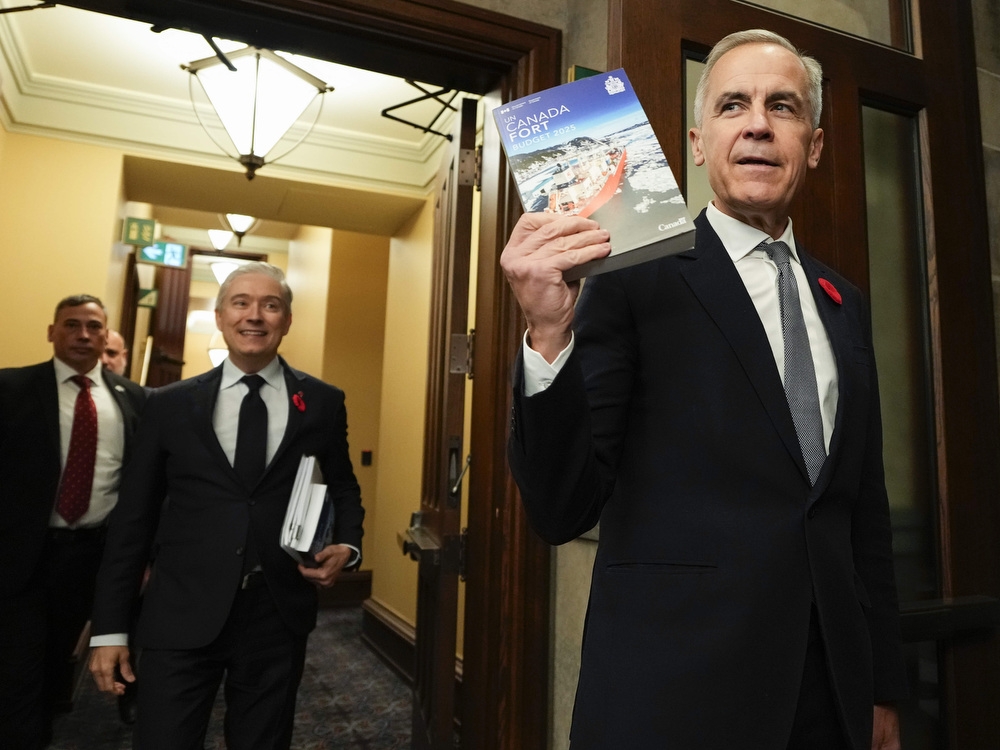

However, a dramatic shift occurred following the release of the 2025 federal budget. Jacques, appearing before the Senate finance committee, revealed a complete reversal of his previous outlook, stating the budget’s projections now suggest long-term fiscal sustainability.

Senator Krista Ross directly questioned this change, referencing Jacques’ earlier “cliff” warning and asking what prompted the revised opinion. The answer lay in the evolving data and a clearer understanding of the government’s financial plans.

Jacques clarified that his initial concerns stemmed from incomplete information. At the time, roughly $100 million in annual spending remained unclear, and the budget hadn’t yet detailed how it would meet significant commitments like the NATO defense spending benchmark of 5% of GDP.

Furthermore, the initial analysis included an estimated $20 billion in outstanding election promises. These factors, combined with the rising debt-to-GDP ratio in medium-term forecasts, fueled the initial pessimistic outlook.

The new budget, however, presented a different picture. While the debt-to-GDP ratio is still projected to rise over the next five years, longer-term forecasts – spanning 30 years – indicate a stabilization of the ratio. This shift, according to Jacques, is the key to the revised assessment.

Essentially, the budget’s detailed projections offered a pathway to stability that wasn’t visible just months prior. The watchdog’s about-face underscores the critical importance of comprehensive financial planning and the dynamic nature of economic forecasting.

The change in perspective highlights how quickly a nation’s financial trajectory can shift with new information and policy decisions, moving from the brink of a “cliff” to a potentially sustainable path.