The true potential of legal sports betting is a hidden giant, dwarfing current revenue reports. Estimates suggest a nationwide rollout could unlock $1.6 billion in annual tax revenue – more than double what’s currently being collected.

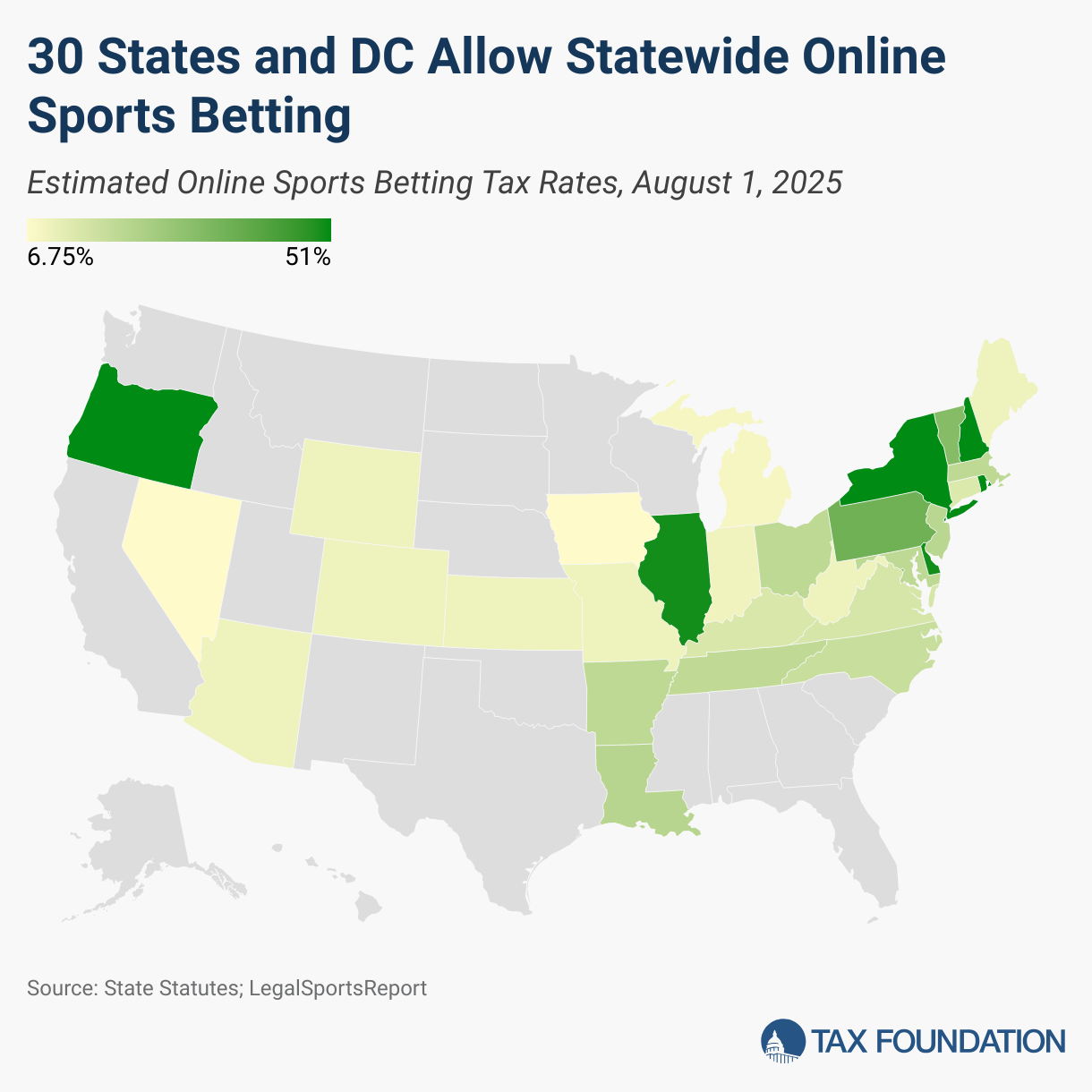

Currently, only 30 states allow the convenience of online betting, leaving a significant portion of potential revenue untapped. Despite a growing trend toward legalization, eleven states remain holdouts, effectively leaving money on the table.

A comprehensive analysis reveals the massive economic impact of full legalization. California, Texas, and Florida stand to gain the most, poised to contribute $570 million, $326 million, and $199 million respectively to state coffers each year.

Missouri recently joined the ranks of states with regulated sportsbooks, signaling a continued shift in public acceptance and legislative action. However, the path to nationwide legalization remains complex, with varying tax rates already in place across the country – ranging from under 7% to over 50%.

The eleven states where sports betting remains illegal – South Carolina, Hawaii, Georgia, Alabama, Alaska, California, Texas, Oklahoma, Minnesota, Utah, and Idaho – represent a substantial untapped market. The potential gains aren’t limited to population centers, either.

Even states with smaller populations could see significant revenue boosts. Hawaii, despite its size, is projected to generate $11 million annually, while Idaho could contribute around $13 million. Alaska, with a large rural population, could still yield $6 million in tax revenue.

The economic benefits extend beyond sheer revenue numbers. Legalization creates jobs, stimulates local economies, and provides a regulated alternative to offshore and illegal betting operations. It’s a win-win scenario for states willing to embrace the change.

Currently, only Georgia has active legislation concerning sports betting legalization, highlighting the considerable work ahead. The future of nationwide sports betting hinges on continued legislative efforts and a growing recognition of its economic potential.