The final months of 2025 witnessed a surprising shift in the processor landscape, as shipments of traditional x86 chips unexpectedly declined. While the holiday season typically fuels a surge in PC sales, a deliberate strategy by Intel dramatically altered the market’s trajectory.

Intel, grappling with production challenges and limited yields, made a pivotal decision: prioritize lucrative server processors over consumer CPUs. This calculated move meant fewer processors reached the hands of PC builders and consumers, creating an opening for rivals to capitalize.

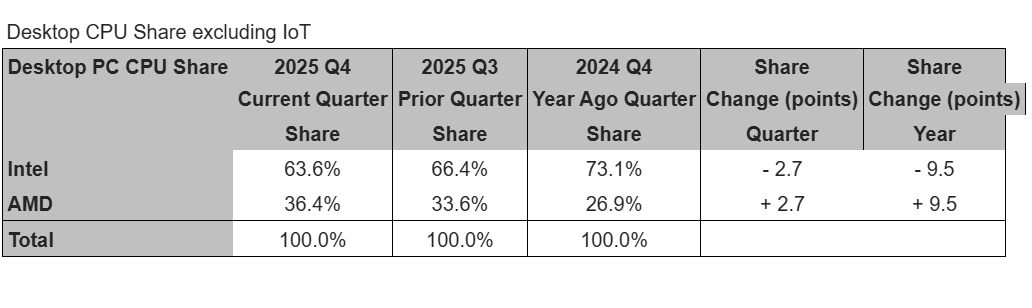

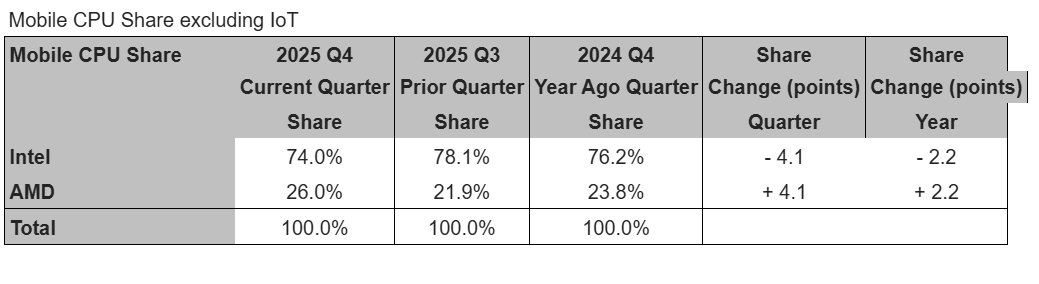

AMD seized this opportunity, achieving record market share in both mobile and desktop processor segments. Their shipments significantly outpaced Intel’s, fueled by strong demand across all product lines, particularly in the crucial mid-range market.

The impact on Intel was most pronounced in the mobile sector. Capacity reallocation led to substantial declines in their mobile CPU shipments, falling far below typical seasonal expectations. AMD, conversely, experienced its strongest quarter yet in mobile processors, dramatically increasing its market presence.

Even the console market experienced a slowdown, with sales of AMD’s system-on-a-chip (SoC) processors for gaming consoles remaining stagnant. Despite this, AMD anticipates a potential refresh of consoles in 2027, signaling a future resurgence in that area.

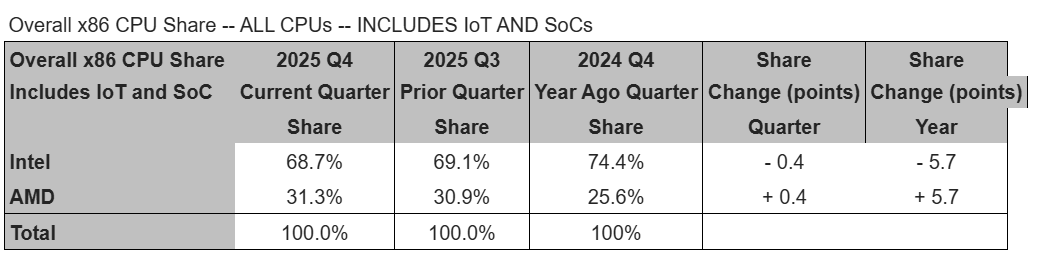

Historically, Intel commanded approximately 80% of the PC processor market, leaving 20% for competitors. That dominance has steadily eroded, now settling closer to a 70-30 split, reflecting AMD’s growing influence.

The evolving landscape also includes the presence of Arm-based processors, though their overall share experienced a slight dip. Determining precise Arm shipments proved challenging due to strong PC sales, but estimates place their market share around 13.3%, a small decrease from the previous year.

Interestingly, both Intel and AMD saw significant growth in the server processor market. Intel’s server shipments surged, exceeding double the seasonal average, while AMD experienced an even more impressive tripling of its average growth rate in this critical sector.

While differing slightly in specific numbers, independent research firms corroborate the overall trend: a shift in market share driven by Intel’s strategic prioritization and AMD’s ability to meet existing demand. The coming months will reveal if these trends continue, particularly as potential memory constraints and evolving software support come into play.

The processor market is a dynamic arena, constantly reshaped by technological advancements and strategic decisions. The events of late 2025 serve as a powerful reminder that even established leaders can face disruption, and that adaptability is key to long-term success.