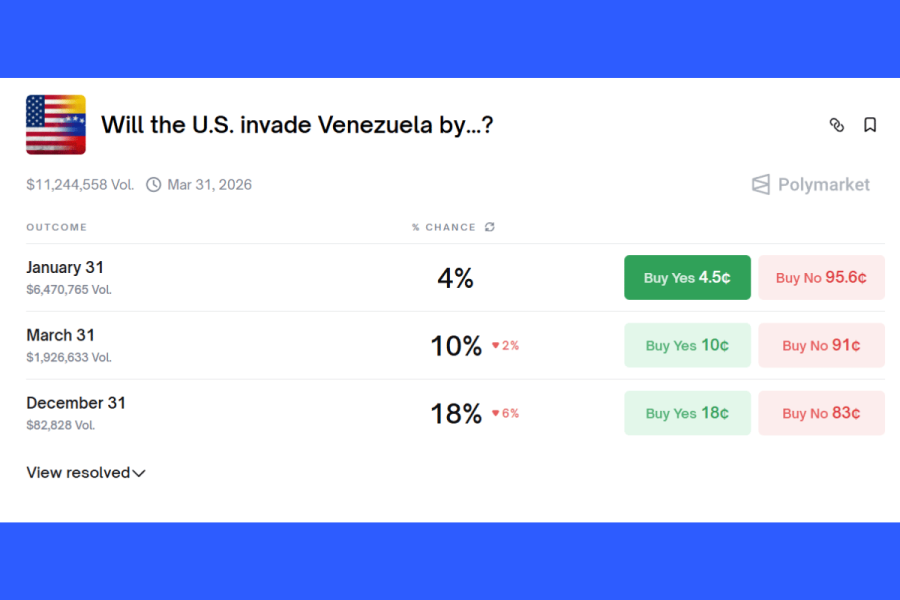

A high-stakes gamble unfolded involving a prediction market and the fate of a nation. Millions were wagered on whether the U.S. military would intervene in Venezuela, a bet now shrouded in dispute and accusations of unfair practice.

The core of the conflict centers on the definition of “invasion.” Polymarket, the platform in question, is refusing to honor payouts, arguing that the capture of former president Nicolas Maduro didn’t constitute a full-scale invasion – only the establishment of military control over Venezuelan territory would trigger settlement.

One trader, remarkably, walked away with a potential $400,000 windfall after correctly predicting Maduro’s removal from power by the end of January. This savvy investor risked over $32,000, capitalizing on odds that surged from a mere 7 cents to a full dollar as Maduro was flown out of the country.

However, the victory is far from secure. Polymarket maintains its stance, stating that a “military offensive intended to establish control” is the required condition for resolving the contract. The $10.5 million total wagered hangs in the balance, with deadlines extending into March and December.

This isn’t an isolated incident. Another prediction market, Kalshi, is facing similar criticism for allegedly mishandling a National Football League bet. A customer correctly predicted the San Francisco 49ers would win over 10.5 games, yet was only offered a refund of their initial stake, not the full winnings.

The initial response from Kalshi was to claim the market was “erroneously determined early,” justifying the reimbursement rather than a proper payout. This sparked outrage among bettors, who questioned the platform’s integrity and fairness.

Following public scrutiny and mounting pressure, Kalshi ultimately reversed its decision and honored the winning NFL bet. The incident highlights a critical difference: prediction markets operate with significantly less oversight than traditional sportsbooks.

These cases raise serious questions about the reliability and transparency of prediction markets. While offering a unique avenue for speculation, the lack of robust regulation leaves participants vulnerable to disputed outcomes and potentially unfair practices.

The unfolding drama serves as a stark reminder that even in the realm of prediction, the fine print – and the interpretation of it – can make all the difference between a substantial profit and a devastating loss.