A wave of optimism swept through the Philippine bond market last week, triggered by surprisingly sluggish economic growth figures. Government security yields, typically moving in opposition to price, experienced a noticeable decline, hinting at potential shifts in monetary policy.

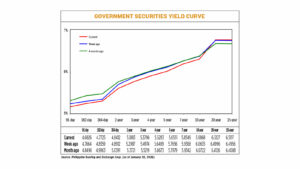

The average yield on these securities dipped by 7.14 basis points, according to data analyzed as of January 30th. Shorter-term Treasury bills saw the most significant drops, with yields on 91-, 182-, and 364-day bills falling to 4.6826%, 4.7725%, and 4.8412% respectively.

This downward trend extended to medium-term bonds as well. Two-, three-, four-, five-, and seven-year Treasury bonds all registered rate decreases, ranging from 8.19 to 12.06 basis points. The market reacted swiftly to the economic news.

However, the long end of the curve presented a mixed picture. While the 10-year bond yield decreased by 7.67 basis points, the 20- and 25-year debt papers saw slight increases of 1.31 and 1.61 basis points, respectively. Trading volume also increased, reaching P118.3 billion—a jump from the previous week’s P102.98 billion.

The catalyst for this market movement was the revelation that the Philippines’ GDP growth for 2025 had fallen to 4.4%, a significant slowdown from the 5.7% recorded in 2024. This marked the weakest annual growth in five years, excluding the pandemic-affected year of 2020.

Analysts believe this weaker-than-expected performance provides the Bangko Sentral ng Pilipinas (BSP) with increased latitude to consider further easing of monetary policy. The prospect of a rate cut gained traction as markets digested the data.

One bond trader explained that the GDP figures signaled a sharper loss of growth momentum than anticipated, prompting expectations that the BSP might need to intervene with policy support. This expectation fueled a rally in bonds, driving yields down, particularly at the shorter end of the curve.

The disappointing growth data has shifted the focus to potential economic risks, reinforcing the idea that a more supportive monetary policy could be on the horizon. This creates a continuing downward pressure on local interest rates, especially for shorter-term securities.

While the BSP Governor indicated that the upcoming February 19th policy review would consider the economic performance, a weak growth print doesn’t guarantee further easing. The central bank has already reduced benchmark borrowing costs by a cumulative 200 basis points since August 2024, bringing the policy rate to 4.5%.

The US Federal Reserve’s decision to pause its own easing cycle and maintain a cautious tone did temper the rally, particularly for longer-dated bonds. Global interest rate movements continue to exert influence on the Philippine market.

Looking ahead, all eyes are now on the release of January’s Philippine inflation data this week. This figure will be crucial in determining the BSP’s policy decision and could further influence bond yields. Stable inflation would strengthen the case for lower rates.

Additionally, the Treasury’s auction of P30 billion in reissued seven-year bonds on Tuesday will be closely watched. The auction’s success will serve as a test of demand in the medium-term segment of the curve and could impact near-term yield movements.