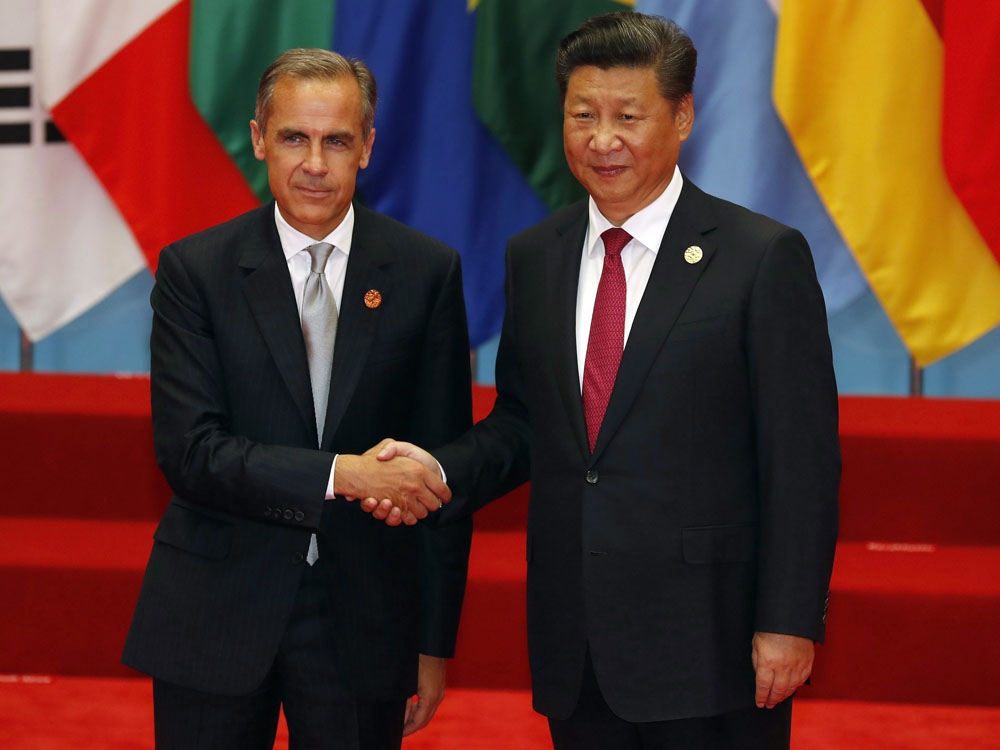

The fate of Canada’s next generation of submarines is rapidly approaching a critical juncture. Prime Minister Mark Carney recently concluded a tour of a South Korean submarine facility, a key step in evaluating bids for a contract worth billions. The visit underscored a growing defense partnership between Canada and South Korea, marked by a new agreement for increased military cooperation.

Carney’s inspection of Hanwha Ocean’s shipyard, alongside Defence Minister David McGuinty and Royal Canadian Navy Commander Vice-Admiral Angus Topshee, offered a firsthand look at the advanced technology in contention. Automated welding robots and a sprawling production facility showcased Hanwha’s capabilities, leaving Topshee to describe the submarine itself as “beautiful.”

The urgency is palpable. Canada’s current Victoria Class submarines are nearing the end of their service life, with only one currently operational. Replacing these aging vessels is paramount, particularly as Canada seeks to strengthen its military presence in the Arctic. A decision within the next year, as Topshee hopes, is crucial.

Hanwha is aggressively vying for the contract, promising a swift delivery schedule. They claim to be able to deliver the first of up to twelve submarines by 2032, and subsequently provide one new vessel each year. This speed is a significant selling point, potentially saving Canada billions in costly repairs to its existing fleet.

The competition isn’t simply about submarines; it’s about forging deeper economic ties. Hanwha has proposed substantial investments in Canadian industries, including lithium-ion battery production and critical minerals. This offer aims to deliver significant economic benefits alongside a new naval fleet.

However, Hanwha faces a formidable rival in Germany’s ThyssenKrupp Marine Systems (TKMS). Just weeks prior, Carney toured TKMS’s facilities, weighing their proposal. Germany and Norway recently launched a diplomatic push, emphasizing the benefits of joining a collaborative network of nations operating the same submarine design.

TKMS boasts a long and established history, having supplied a significant portion of NATO’s conventional submarine fleet. They present themselves as the less risky option, offering a proven track record. While their delivery schedule isn’t as aggressive as Hanwha’s, they maintain they can still meet Canada’s 2035 deadline.

Experts suggest this procurement is moving at an unprecedented pace. The multi-billion dollar contract is attracting intense competition, with both bidders understanding the strategic importance of securing the deal. It represents a pivotal opportunity for Canada to diversify its trade relationships.

The choice before Prime Minister Carney is more than just a military decision. It’s a strategic lever with the potential to reshape Canada’s industrial landscape and solidify its position on the global stage. The contract represents a tangible way to translate trade ambitions into concrete economic benefits.

South Korea, meanwhile, is actively seeking to expand its defense industry and become a major arms exporter. Driven by a desire to reduce reliance on the United States, South Korea is rapidly increasing its military exports and seeking to establish itself as a key player in the global arms market.