The International Space Station, a beacon of collaborative space exploration, is nearing the end of its operational life, slated for decommissioning in 2030. This impending retirement has ignited a fierce competition among aerospace firms vying to build the world’s first commercial space station, ushering in a new era of private space endeavors.

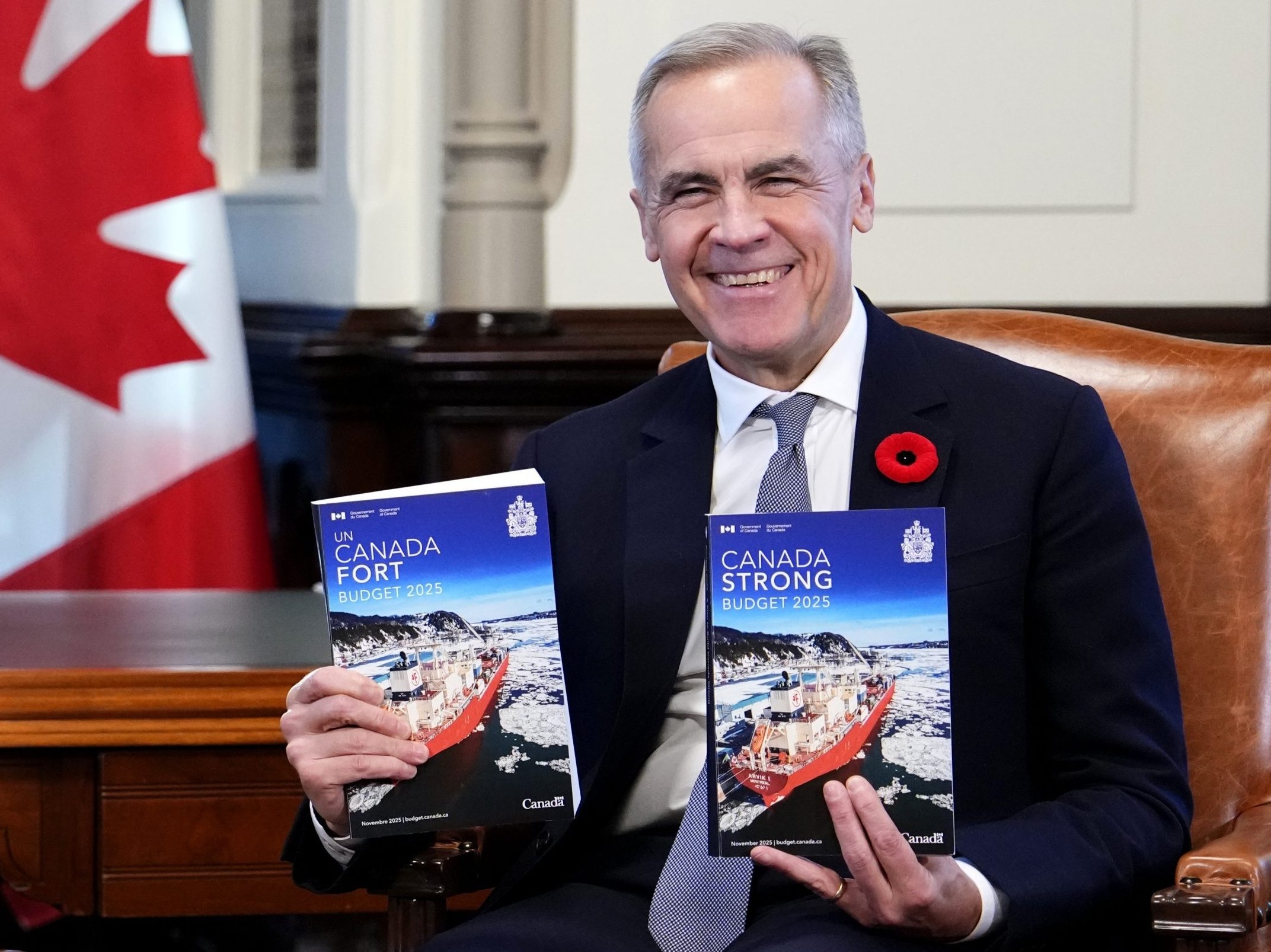

Vast, a California-based company founded in 2021, is a leading contender in this race. Their initial offering, Haven-1, is designed with a focus on crew comfort and is scheduled for launch in May 2026. The plan involves rotating crews of four astronauts over a three-year lifespan, marking a significant step towards sustained human presence in low Earth orbit.

However, Vast isn’t alone in this ambitious undertaking. Axiom Space, Voyager Space in partnership with Airbus, and even Jeff Bezos’s Blue Origin are all aggressively pursuing their own commercial space station designs. The stakes are incredibly high, with the future of space access hanging in the balance.

A pivotal moment arrives in April 2026, when NASA is expected to award up to $1.5 billion in funding for the development of these commercial stations. This financial backing is crucial, as space agencies increasingly seek to shift from directly managing infrastructure to purchasing services from private companies.

This shift in strategy reflects a broader change in NASA’s priorities. Focused on returning to the Moon by the end of the decade and eventually establishing a lunar base, the agency wants to concentrate its resources on ambitious crewed missions rather than the day-to-day operations of a space station.

The pressure to innovate is immense. Companies are operating on “aggressive timelines,” demanding a departure from traditional, slower approaches to space development. Thales Alenia Space, for example, is already building pressurized modules for Axiom’s station, aiming for operational status as early as 2028, building on their extensive experience with the ISS.

The cost of access to space has been dramatically reduced in recent years, largely thanks to SpaceX’s reusable launch vehicles. Just fifteen to twenty years ago, sending a single kilogram into orbit cost an astounding $60,000. Projections suggest that SpaceX’s Starship, when operational around 2030, could bring that cost down to less than $200 per kilogram.

Despite these advancements, operating a commercial space station remains a substantial financial undertaking. While the reduced launch costs are transformative, questions remain about the long-term profitability of these ventures. Success hinges on attracting a diverse range of customers, from government agencies to private sector clients.

Vast anticipates that 85 percent of its revenue will come from state agencies, with the remaining 15 percent from private customers. They aim to become a global service provider, offering access to space for training and research to countries worldwide, potentially for as little as $100 million per astronaut.

This new era of commercial space stations promises to democratize access to orbit, opening up opportunities for scientific discovery, technological innovation, and potentially, a future where space is accessible to a wider range of individuals and organizations than ever before.