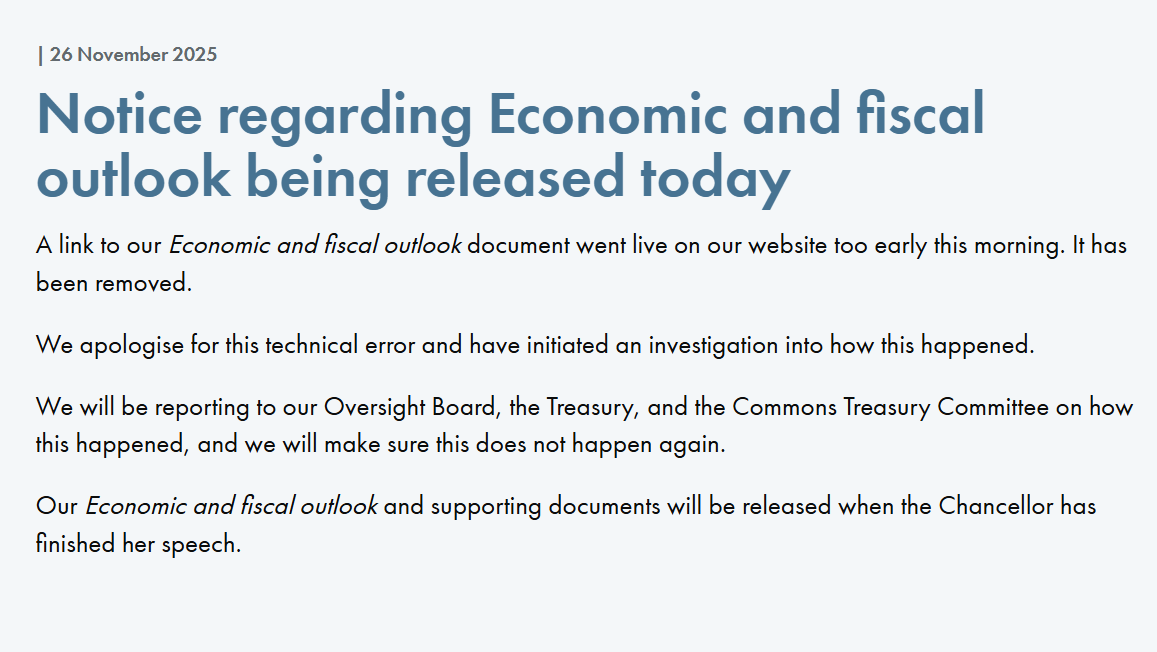

A shadow of frustration fell over Westminster as a highly sensitive economic assessment was unexpectedly released into the digital realm. The UK’s Office for Budget Responsibility (OBR) inadvertently published its full analysis of the upcoming budget hours before the Chancellor was scheduled to deliver her statement to Parliament.

The leak, quickly retracted, revealed a crucial detail: a significant overhaul of gambling taxation. This wasn’t a minor adjustment, but a sweeping change projected to generate £1.1 billion by 2029-30, sending ripples through the industry even before the official announcement.

Chancellor Reeves acknowledged the breach at the start of her speech, expressing her disappointment and emphasizing the seriousness of the error. The OBR swiftly accepted full responsibility, but the damage was done – the cat was out of the bag, and markets reacted instantly.

The proposed changes target online gambling specifically, with remote gaming duty slated to jump from 21 to 40 percent by April 2026. A new 25 percent general betting duty for online platforms will follow in April 2027, while traditional forms like self-service betting terminals and horseracing will remain exempt. Bingo duty is set to be abolished.

The financial markets responded with immediate force. Shares in Entain, owner of Ladbrokes, plummeted nearly 3 percent, while evoke plc, formerly 888 Holdings, experienced a dramatic 12.4 percent drop, reflecting investor anxieties about the impending tax burden.

Beyond the gambling sector, the leaked report painted a broader picture of economic headwinds. The OBR cautioned that the economic outlook has become “more challenging and uncertain,” forecasting a modest 1 percent GDP growth this year and a peak inflation rate of 3.7 percent in mid-2025.

The national debt remains stubbornly high, projected to hover around 96 percent of GDP, and the tax burden is expected to reach a historic 37.7 percent by 2027-28. These figures underscore the delicate balancing act facing the government as it navigates a complex economic landscape.

Despite the challenging forecasts, the report confirmed the government is currently on track to meet its fiscal rules, albeit by a narrow margin. The OBR highlighted a meager £9.9 billion buffer against the fiscal mandate in 2029-30 – a fraction of the reserves typically maintained by Chancellors.

The OBR also noted limitations in the data provided, stating that policy costings for some measures arrived late and lacked sufficient detail. This constraint underscores the complexities of economic forecasting and the challenges of accurately assessing the impact of new policies.