A surprising voice has entered the debate surrounding the ethics of prediction markets: the CEO of Kalshi, Tarek Mansour. He’s publicly voiced strong support for a proposed bill that would explicitly ban government officials from participating in these markets, a move signaling a commitment to integrity within a rapidly evolving financial landscape.

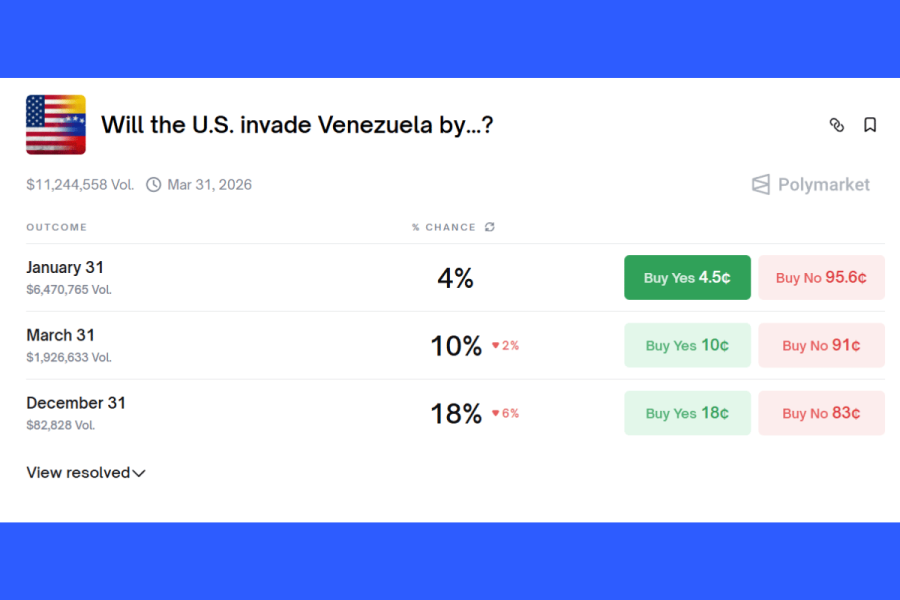

The potential legislation, spearheaded by New York Representative Ritchie Torres and tentatively titled the ‘Public Integrity in Financial Prediction Markets Act of 2026,’ arrives amidst heightened scrutiny. Recent events, including a substantial payout on a bet concerning Venezuelan President Nicolás Maduro, have ignited concerns about the potential for insider trading and its implications, particularly during times of international tension.

Mansour took to LinkedIn to clarify Kalshi’s position, stating plainly that insider trading is – and always has been – prohibited on their platform. He drew a crucial distinction between regulated American markets like Kalshi and the largely unchecked, offshore alternatives where the alleged misconduct occurred.

Kalshi’s deliberate approach to regulation wasn’t accidental. Mansour revealed the company intentionally delayed its launch for years, prioritizing securing full US regulatory approval. This commitment, he emphasized, stemmed from a fundamental belief in doing things “the right way” from the outset.

The proposed bill, according to Representative Torres, isn’t simply about market fairness; it’s about safeguarding the integrity of government itself. In a public statement, Torres expressed his concern that allowing officials to profit from prediction markets creates a dangerous risk of corruption at the highest levels.

Mansour’s support for the bill isn’t merely symbolic. He highlights that Kalshi already adheres to the principles the legislation aims to codify. However, he stresses a critical limitation: the American bill will only apply to regulated US companies, leaving the potentially problematic offshore platforms largely unaffected.

This situation underscores a growing tension within the prediction market world. While companies like Kalshi champion transparency and regulation, the allure of unregulated markets continues to draw activity, raising questions about oversight and the potential for abuse.