The modern workforce is undergoing a quiet revolution. A significant and consistent portion of Canadians – 21% annually – are now actively participating in the “gig economy,” embracing freelance work as a regular part of their financial lives.

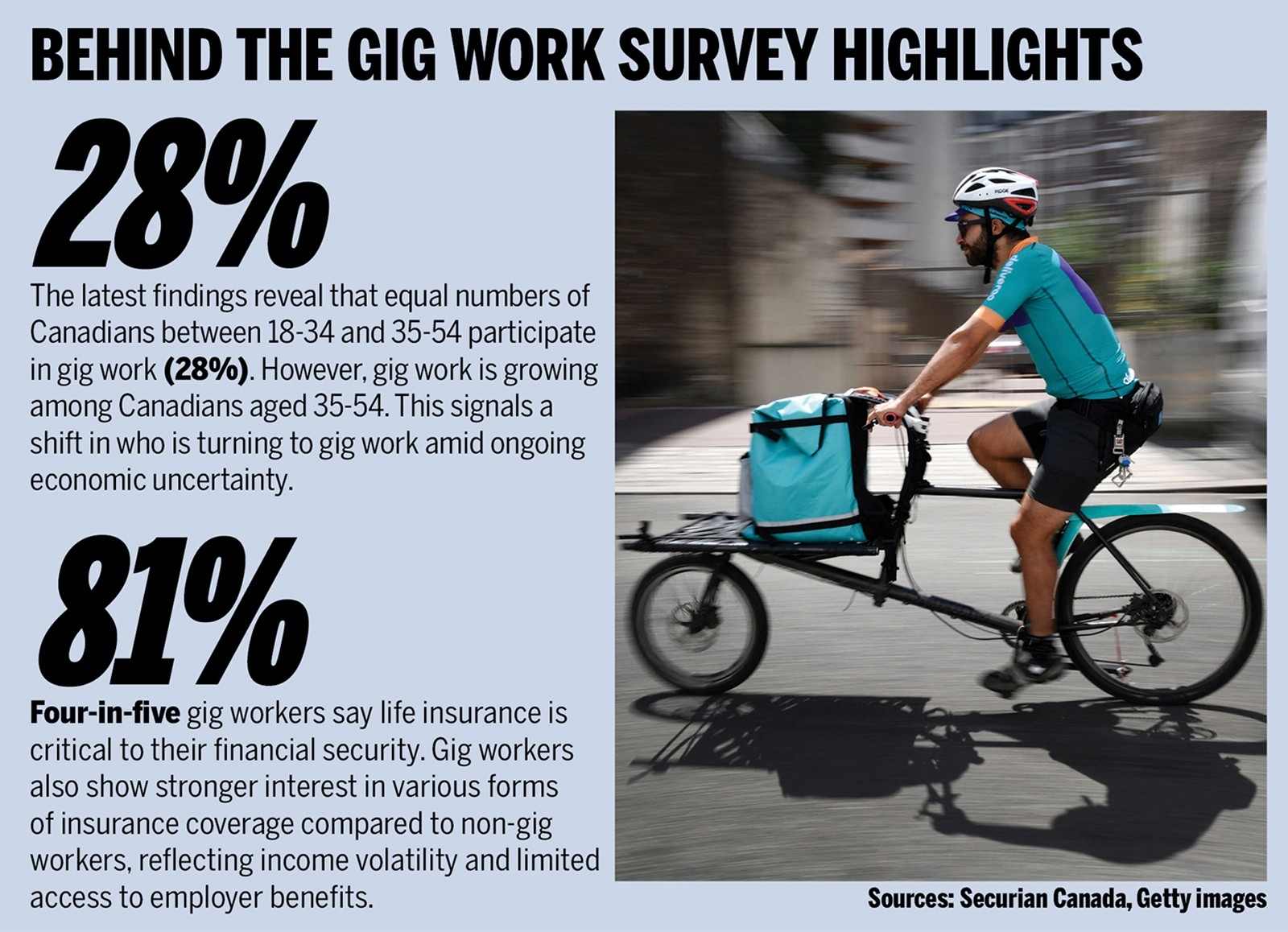

This isn’t a trend limited to a single demographic. Surprisingly, the participation rate is nearly identical across age groups, with 28% of both 18-34 year-olds and 35-54 year-olds engaging in gig work.

While some pursue these opportunities for enjoyment, the primary driver is increasingly financial. Nearly a quarter (24%) of gig workers are strategically using this work to bolster their financial future, a shift from previous years when personal fulfillment was a more common motivation.

The reality for many is stark: over half (57%) of gig workers rely on this supplemental income to make ends meet, bridging the gap between their primary employment and rising living costs. For most, it represents a modest but vital 15% of their total income.

This reliance highlights a critical vulnerability. Gig workers demonstrate a strong awareness of their financial precarity, with an overwhelming 81% recognizing the importance of life insurance for their security.

However, access to that security is uneven. A concerning 18% of gig workers currently lack insurance coverage altogether, and among those who *do* have it, a majority (57%) depend on policies held by others – relinquishing direct control over their financial well-being.

The types of gig work are diverse, reflecting a rapidly evolving job market. Thirty percent are offering specialized services like photography or consulting, while a quarter are engaged in online commerce, and 21% provide freelance digital skills like tutoring or graphic design.

Importantly, gig work rarely exists in isolation. A substantial 73% of gig workers also hold traditional full-time or part-time employment, suggesting this is often about supplementing income rather than complete career replacement.

The escalating cost of living is the most frequently cited reason for turning to gig work, with nearly a third (31%) of participants identifying it as a key factor. It’s a pragmatic response to economic pressures, a way to navigate an increasingly expensive world.