The Philippine peso experienced a slight rebound against the dollar, closing at P58.86 on Friday – a modest gain of 8.5 centavos from the previous day’s trading. This movement follows a weekly increase of 23 centavos, signaling a potential shift in the currency’s trajectory.

Despite the gains, trading remained largely stable, briefly touching P59 before a wave of selling on peso weakness emerged. This fluctuation coincided with the release of lower-than-expected GDP figures, prompting some investors to capitalize on profits in the afternoon session.

The Philippines’ economic growth slowed to 3% in the final quarter of 2025, resulting in a full-year average of 4.4% – falling short of the government’s 5.5%-6.5% target. This deceleration has significantly increased expectations for a potential interest rate cut by the Bangko Sentral ng Pilipinas (BSP).

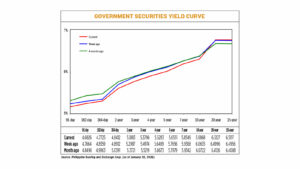

Analysts suggest the BSP’s Monetary Board, scheduled to meet on February 19th, may consider reducing benchmark rates. The central bank has already implemented a cumulative 200 basis point reduction since August 2024, bringing the policy rate to a three-year low of 4.5%.

Looking ahead, the peso is predicted to remain within a narrow trading range this week, fluctuating between P58.80 and P59.10. Market participants are keenly awaiting the release of January’s Philippine inflation data on February 5th for further direction.

Global economic factors are also playing a crucial role, particularly developments surrounding the nomination of a new US Federal Reserve chair. The market is carefully assessing how the new leadership will navigate the delicate balance between controlling inflation and fostering economic growth.

The appointment of Kevin Warsh to lead the US Federal Reserve has introduced a new dynamic. While the decision resolves uncertainty, investors are now evaluating how Warsh’s historically hawkish stance will align with calls for lower interest rates from US President Donald J. Trump.

Warsh, a former Fed governor known for advocating tighter monetary policy, recently expressed agreement with Trump’s push for rate cuts. This creates a complex scenario as the market anticipates the future direction of US monetary policy and its potential impact on global currencies.

The coming days will be critical as traders and analysts dissect the incoming economic data and assess the implications of the new US Federal Reserve leadership. These factors will undoubtedly shape the peso’s performance and influence broader market sentiment.