A quiet revolution is unfolding in the world of financial forecasting. Kalshi, a New York-based prediction market, recently took a bold step, self-certifying new contracts with the U.S. Commodity Futures Trading Commission – contracts centered around the unpredictable drama of professional sports draft lotteries.

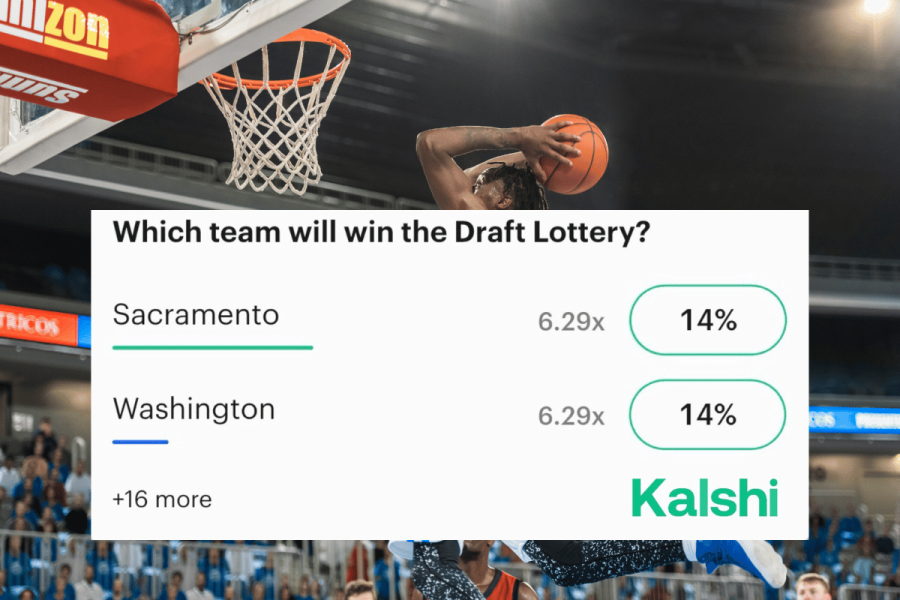

The core of this innovation lies in a simple question: can you accurately predict which team will land the coveted first pick? Kalshi has launched contracts allowing traders to bet on the winner of league draft lotteries, and even on the pre-draw odds of each team. This isn’t about traditional sports betting; it’s about harnessing collective intelligence to forecast future outcomes.

This move was made possible by a regulatory pathway allowing Kalshi to launch these contracts without immediate CFTC approval. As long as the agency doesn’t object within a specific timeframe, trading can commence, mirroring a similar expansion into college basketball outcomes earlier in 2025.

The timing is crucial. The CFTC, under the leadership of Chairman Michael S. Selig, is undergoing a significant shift in philosophy. A previously restrictive stance towards event contracts – those tied to real-world occurrences – is giving way to a more open approach.

Chairman Selig has actively dismantled policies from the previous administration, including a proposed rule that threatened sweeping limitations, and even outright bans, on contracts involving sports and politics. He views this earlier proposal as an overreach, a misguided attempt to regulate based on subjective merit rather than established legal frameworks.

The agency also rescinded a cautionary advisory regarding sports-related contracts, acknowledging it had created unnecessary confusion for market participants. Selig is now focused on fostering “responsible innovation” within the derivatives markets, aligning with the original intent of the Commodity Exchange Act.

Kalshi has consistently maintained that its markets operate as federally regulated derivatives, distinct from traditional sports wagering governed by state laws. This position has led to legal battles with states like New Jersey and Nevada, who have questioned the legality of these contracts, deeming them a form of illegal gambling.

While some federal courts have sided with Kalshi, asserting the CFTC’s authority can supersede certain state actions, the legal landscape remains contested. The debate centers on where to draw the line between legitimate financial instruments and prohibited gambling activities.

Industry advocates are celebrating the CFTC’s change in direction, praising Selig’s commitment to defending the agency’s jurisdiction over event contracts. They see this as a vital step towards unlocking the potential of prediction markets.

However, not everyone is convinced. Critics argue that contracts tied to draft lottery outcomes venture too close to pure chance, blurring the lines between financial hedging and gambling. Concerns about potential manipulation and the need for robust state oversight are being raised.

The expansion into draft lottery predictions represents a pivotal moment. It’s a test of how far federally regulated prediction markets can extend their reach, and a challenge to define the boundaries of this emerging financial frontier.

As the CFTC and SEC work to clarify the distinction between commodity derivatives and security-based instruments, the future of prediction markets – and their role in forecasting real-world events – hangs in the balance.