A chilling question appeared on the prediction market Polymarket: “Artemis II explodes?” The listing, quickly captured in a screenshot and amplified across social media, assigned an 8% probability to the catastrophic failure of a space mission. The immediate reaction was visceral, sparking outrage and a debate about the boundaries of acceptable speculation.

The outcry centered on the optics of betting on human tragedy. One comment encapsulated the widespread discomfort: “Wagering on people dying should not be legal!” The question wasn’t simply about the possibility of failure, but the unsettling act of profiting from potential disaster, even in a hypothetical sense.

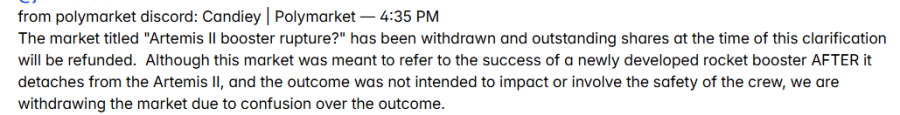

Polymarket swiftly responded, clarifying the market’s intent. It wasn’t a bet on the safety of the astronauts, but on a specific technical event – a booster-stage rupture after separation. The company emphasized the distinction, stating the market focused on hardware failure, not crew injury or loss of life. However, the explanation struggled to outpace the viral spread of the original, alarming headline.

Recognizing the damage, Polymarket altered the listing’s title to “Artemis II booster rupture?” – a change framed as a matter of “clarity.” But the initial impression had already taken hold, fueling a larger conversation about the ethics of prediction markets and their potential to exploit sensitive events.

Ultimately, Polymarket withdrew the market entirely, refunding all outstanding shares. The company acknowledged the confusion surrounding the outcome, reiterating that the intention was to assess the success of the booster *after* crew separation, and not to speculate on astronaut safety. The decision came as the debate intensified, highlighting the challenges of navigating public perception in the age of instant information.

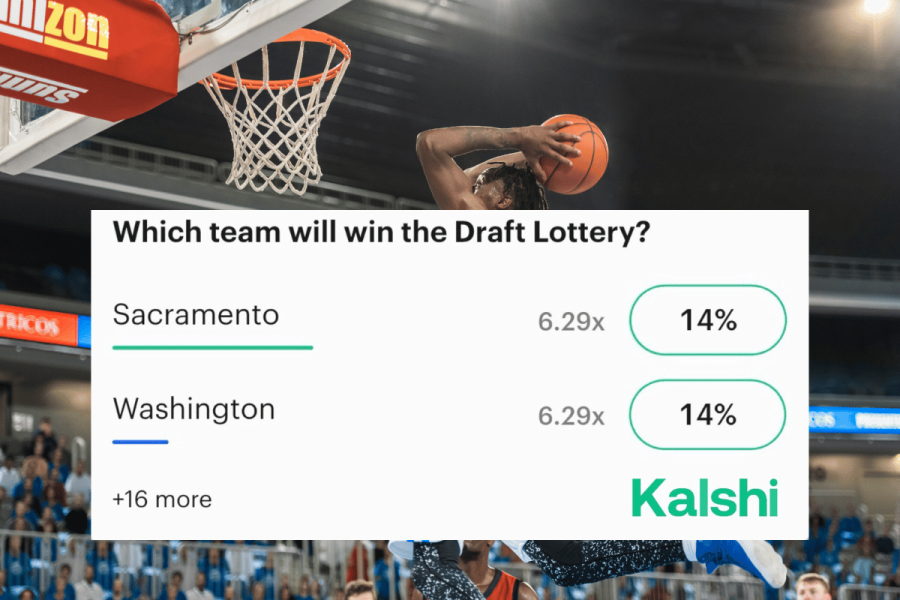

Prediction markets like Polymarket operate by allowing users to trade “yes” or “no” shares based on real-world outcomes. Proponents believe these platforms can aggregate collective intelligence, revealing hidden probabilities and offering valuable insights. However, critics argue that focusing on disasters or tragedies crosses a moral line, turning human suffering into a commodity.

The Artemis II incident reignited this debate. Even with a narrowly defined technical focus, the initial framing of the market invited a darker interpretation. In the rapid-fire environment of social media, nuance often vanishes, leaving behind only the most sensational and emotionally charged elements.

This controversy isn’t isolated. Reports suggest a pattern of differing content moderation standards across prediction market platforms. While one platform removed markets related to a controversial commentator, similar bets remained active on Polymarket, raising questions about risk tolerance and industry oversight.

Further scrutiny revealed a pattern of Polymarket actively pursuing virality on social media, sometimes at the expense of accuracy. A widely circulated claim about a WNBA game and a supposed “no bag policy” – intended to prevent the throwing of objects – proved to be entirely false, yet garnered millions of views before being debunked.

The incident underscores a growing concern: are prediction markets prioritizing engagement and growth over responsible content creation and ethical considerations? The line between insightful prediction and exploitative speculation is becoming increasingly blurred, demanding a closer look at the industry’s practices and its impact on public discourse.