A recent review of federal financial disclosures filed by Minnesota Representative Ilhan Omar reveals a significant surge in reported assets linked to her husband’s business ventures. These newly documented holdings represent a dramatic increase compared to previous years, sparking intense scrutiny and raising questions about the couple’s financial picture.

The disclosures surfaced as Representative Omar has publicly dismissed claims of being a millionaire, characterizing such assertions as “ridiculous.” However, the sudden and substantial appearance of these assets, valued at potentially millions of dollars, has fueled debate and prompted calls for further investigation.

The bulk of the reported assets are tied to two of her husband’s businesses: a winery located in Santa Rosa, California, and a venture capital firm based in Washington, D.C. These ventures have experienced particularly striking valuation increases in the past year, drawing considerable attention.

eStCru LLC, the California-based winery, saw its reported value leap from a range of $15,000 to $50,000 in 2023 to a staggering $1 million to $5 million in 2024. Rose Lake Capital, the D.C. venture capital firm, experienced an even more dramatic shift, jumping from a reported value of $1 to $1,000 in 2023 to an impressive $5 million to $25 million in 2024.

Despite the reported increase in wealth, Representative Omar’s disclosures also indicate the presence of outstanding debts, including student loans, auto payments, and credit card balances. This juxtaposition of significant assets and existing financial obligations adds another layer of complexity to the situation.

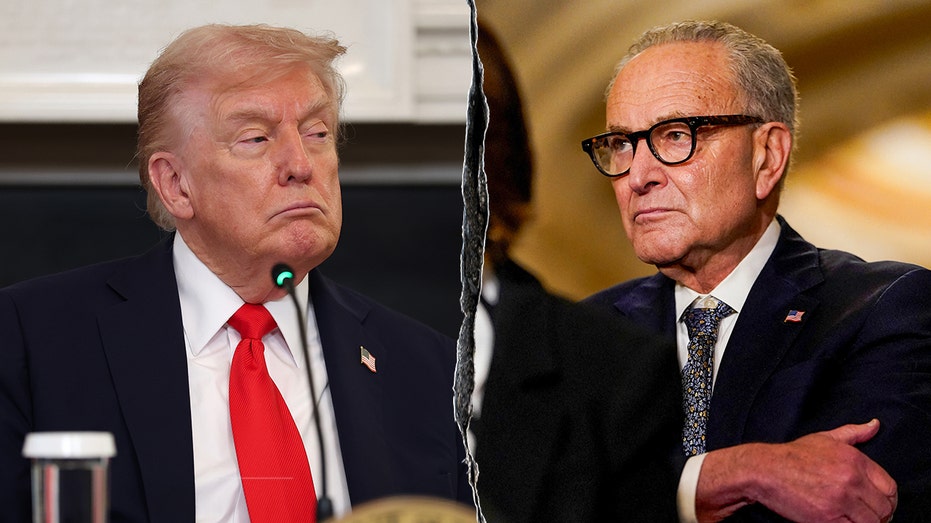

The escalating scrutiny has extended to prominent figures, including former President Donald Trump, who has publicly questioned Representative Omar’s finances and called for a Department of Justice investigation into the couple’s shared wealth. Trump claimed the total wealth reached $44 million, stating, “Time will tell all.”

Minnesota itself has recently been the focal point of several high-profile fraud cases, highlighting broader concerns regarding financial oversight within the state. This context further amplifies the questions surrounding the recent disclosures and the need for thorough examination.